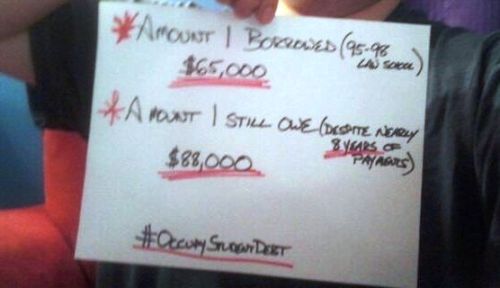

Many psychotherapists are dealing with being un(der)employed and having massive student loan debt. If you personally are not then I'm guessing you have friends who are. In my experience people often deal with these fears privately which leads to less chances for solidarity. I'd like to live in a world where people aren't alone with highly emotional and highly complex issues. Here are stories of other people facing student loan debt pressures. Feel free to submit your own.

OccupyStudentDebt.com

2 comments:

As someone who just completed an MA program and is MFT eligible (should I complete the MFT intern process), I wanted to name that there are options to make student debt easier in the short, and possibly long,haul. (at least in California)

1. Emergency Forebearance -if you are in dire straits, federal loans can be put on hold almost 3 years. Interest still accumulates though, but no payments.

2. working for a nonprofit- apparently if you do this for 10 years, and submit pay stubs to the federal loan folks, your debts could be forgiven in ten years.

3. Income based repayment plan- specifically you need to ASK for all of this as all of the above. Payments based on what you earn .

4. deferal during an internship. I *think* you can do this, but not positive.

Hope that helps someone out there!

Thanks Jessica!

Post a Comment